Mohegan Tribal Gaming Authority is cutting staff and preparing for a leadership change as it posted higher fourth-quarter revenues but continued losses driven by weaker results at its core properties. The Uncasville-based casino and entertainment operator confirmed Thursday it initiated workforce reductions after the quarter ended, a move expected to generate about $9 million in […]

Mohegan Tribal Gaming Authority is cutting staff and preparing for a leadership change as it posted higher fourth-quarter revenues but continued losses driven by weaker results at its core properties. The Uncasville-based casino and entertainment operator confirmed Thursday it initiated workforce reductions after the quarter ended, a move expected to generate about $9 million in annual savings. Additionally, CEO Ray Pineault said he will step down Dec. 28 after nearly 25 years with the Mohegan Tribe. The cost-cutting effort follows a quarter in which Mohegan reported $453 million in net revenues for the period ended Sept. 30, up 4% year over year, fueled largely by a 40% surge in Mohegan Digital revenues. Still, the company posted a $2.5 million net loss, compared with a $58.9 million loss a year earlier. During an investor call, CFO Ari Glazer said the layoffs “did not impact our 2025 results but will optimize our cost structure going forward,” with savings flowing through over the next four quarters beginning in fiscal 2026. He said the reductions were designed to align staffing with Mohegan’s strategic priorities. He didn’t provide further details on the scope of the job cuts. Thursday’s call also served as Pineault’s final earnings presentation. He praised long-term performance at the company’s flagship properties. Pineault said Mohegan Sun and Mohegan Digital together delivered the company’s strongest operating performance since 2007 for the 12 months ended Sept. 30. He added that Mohegan Sun’s revenue mix continues to diversify, with…

Continue reading

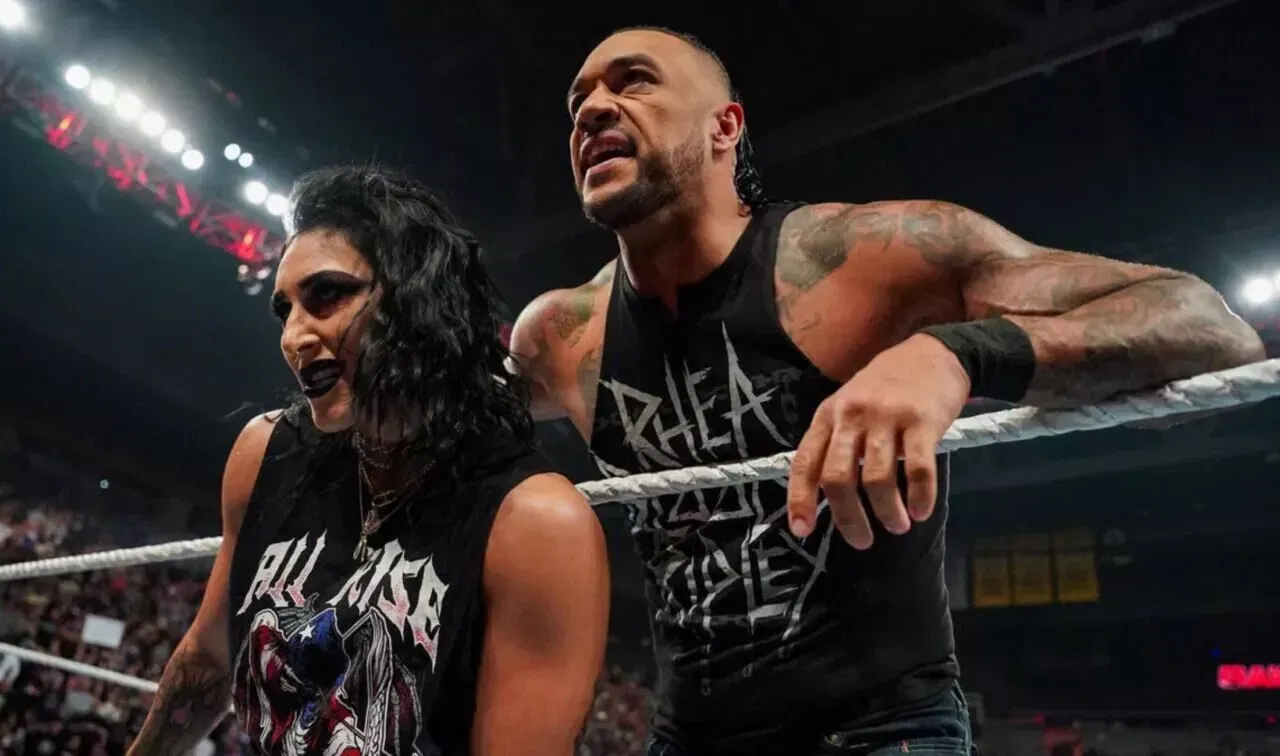

BRUSSELS, BELGIUM AUGUST 26: Rhea Ripley and Damian Priest makes entrance during Monday Night RAW at the Forest National on August 26, 2024 in Brussels, Belgium. (Photo by Heather McLaughlin/WWE via Getty Images.)

BRUSSELS, BELGIUM AUGUST 26: Rhea Ripley and Damian Priest makes entrance during Monday Night RAW at the Forest National on August 26, 2024 in Brussels, Belgium. (Photo by Heather McLaughlin/WWE via Getty Images.)